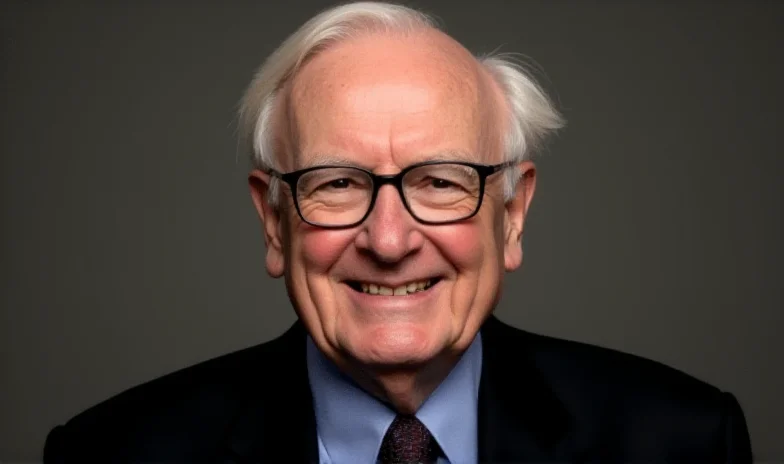

The market landscape is shifting, and several prominent voices are urging investors to adopt a more cautious, defensive stance. Echoing the sentiments of legendary investor Warren Buffett, experts are suggesting it's "not a time to be making big bets."

This isn't just about one person's opinion. A confluence of factors, including potential economic headwinds and policy uncertainties, are prompting a reevaluation of investment strategies. So, what should investors be doing?

Following Buffett's Lead: A Call for Caution

One key indicator is Warren Buffett's recent actions regarding Berkshire Hathaway. After consistently repurchasing Berkshire stock for 24 consecutive quarters, Buffett halted this practice in the third and fourth quarters of 2024. This is particularly noteworthy given Berkshire Hathaway's staggering $334 billion in cash and equivalents on its balance sheet. That's a lot of dry powder!

Why the change of heart? While Buffett hasn't explicitly stated his reasoning, the move is being interpreted as a signal of caution. It suggests that he sees limited opportunities for attractive investments at current valuations, preferring to hold cash in anticipation of potentially better opportunities down the road.

Defensive Strategies in Uncertain Times

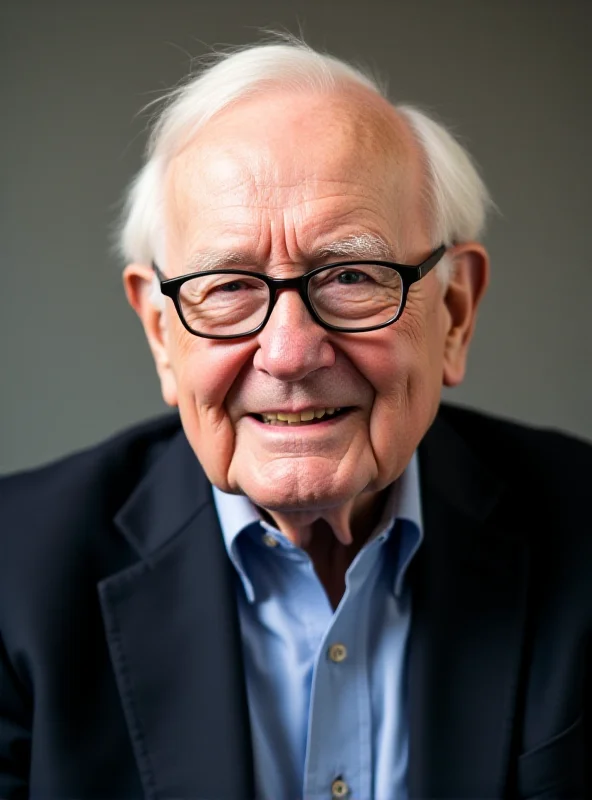

David Rosenberg, a well-known market strategist, is also advocating for a defensive approach. He advises investors to "hunker down" and prioritize cash, defensive stocks, and non-U.S. markets. This strategy aligns with Buffett's philosophy of prioritizing risk management during periods of uncertainty. Rosenberg is not alone in his assessment.

The market is also carefully watching other significant players. As one article notes, "Whenever I review my portfolio, I'm hit with a fresh sense of how much I need to improve as an investor... I find solace in one wonderful decision: Making MercadoLibre (NASDAQ: MELI) my top holding back in 2022." While the author acknowledges their own investment shortcomings, they highlight MercadoLibre as a portfolio-saving investment, drawing parallels to Warren Buffett's successful acquisition of See's Candies.

The "Trumpcession" and Broader Economic Concerns

Adding to the sense of unease, some economists and investors are raising concerns about the potential for a "Trumpcession," a recession potentially triggered by certain policies. Figures like Michael Burry, Jeremy Grantham, Bill Gross, Paul Krugman, and Jeremy Siegel have all voiced concerns about the potential for these policies to hinder growth and fuel inflation. While the term "Trumpcession" is politically charged, the underlying concerns about economic stability are widely shared.

Ultimately, navigating the current market requires a balanced approach. While opportunities undoubtedly exist, a focus on risk management and a willingness to embrace defensive strategies may be prudent in the face of growing economic uncertainty. Investors might consider taking Warren Buffett's and David Rosenberg's advice and prepare for a potentially bumpy road ahead.

"It’s a time to hunker down. Cash, defensive stocks and non-U.S. markets are your best choices now." - David Rosenberg

The key takeaway? Don't make big bets. Be prepared.