The economic landscape is shifting, with several factors contributing to market volatility. From trade policies to interest rates and even personal financial security, there's a lot for investors and consumers to consider.

Trump's Tariff Rollercoaster

Donald Trump's recent executive orders on trade have caused a stir in the business world. Just days after implementing 25% tariffs on Canada and Mexico, he partially reversed them, leaving companies scrambling to adjust. "Companies are assuming tariffs will be a ‘disturbance’ to earnings, but they don’t know how much," notes one analysis. This uncertainty is a major concern for businesses and investors alike, as they struggle to predict the impact on their bottom lines.

Homebuyers Hesitant Amid High Mortgage Rates

The housing market is also facing headwinds. According to Fannie Mae, the vast majority of people in the U.S. believe it is a bad time to buy a home. High mortgage rates are the primary culprit, making homeownership less accessible for many. This sentiment reflects a broader economic unease, as potential buyers weigh the costs and benefits of entering the market.

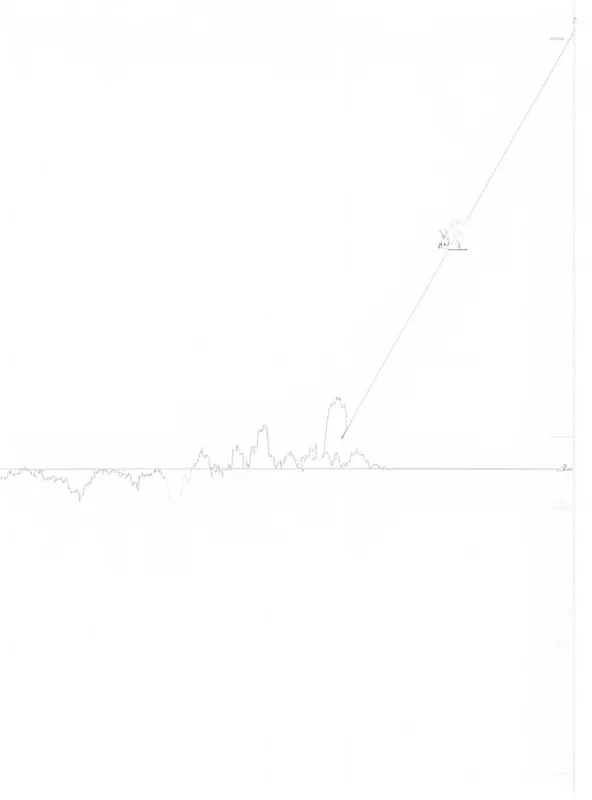

While the housing market faces challenges, some indicators suggest potential opportunities in the stock market. The gold/platinum ratio, a historically reliable market indicator, has recently turned bullish on U.S. equities. This suggests that now might be a good time to buy stocks, with the potential for double-digit gains. Investors are always advised to conduct thorough research and due diligence before making any investment decisions.

Protecting Your Financial Future

Beyond market trends, personal financial security remains a top priority. While printing your Social Security record might seem like a proactive step, it's not enough to truly protect your financial life. There are more effective methods for safeguarding your future, though the specific actions are not detailed here. It's crucial to stay informed and take appropriate measures to secure your financial well-being.

In conclusion, the current market environment is characterized by a complex interplay of factors. From fluctuating trade policies to rising interest rates and the constant need for financial security, staying informed and adaptable is key to navigating these uncertain times.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.