The financial markets are sending mixed signals, leaving investors navigating a complex landscape. From recession warnings to volatile bank stocks and potential buying opportunities, here's a roundup of what's been happening.

Recession on the Horizon?

The bond market is flashing warning signs, predicting a potential recession within the next year. Investors are looking for ways to safeguard their portfolios, and some analysts suggest certain stock funds may offer a buffer against economic downturns. It's a time for careful consideration and strategic planning.

Adding to the uncertainty, the future of student loans remains unclear, especially if the Department of Education were to face closure. This adds another layer of complexity for individuals and families already grappling with economic anxieties.

Bank Stocks Under Pressure

Bank stocks have experienced a turbulent few weeks, with some describing it as a "brutal" period. The sector has faced significant downward pressure, raising concerns among investors. However, some analysts remain unconcerned, suggesting the situation may not be as dire as it appears.

“The market is often driven by fear and greed,” one analyst noted, “and right now, fear seems to be dominating the narrative.”

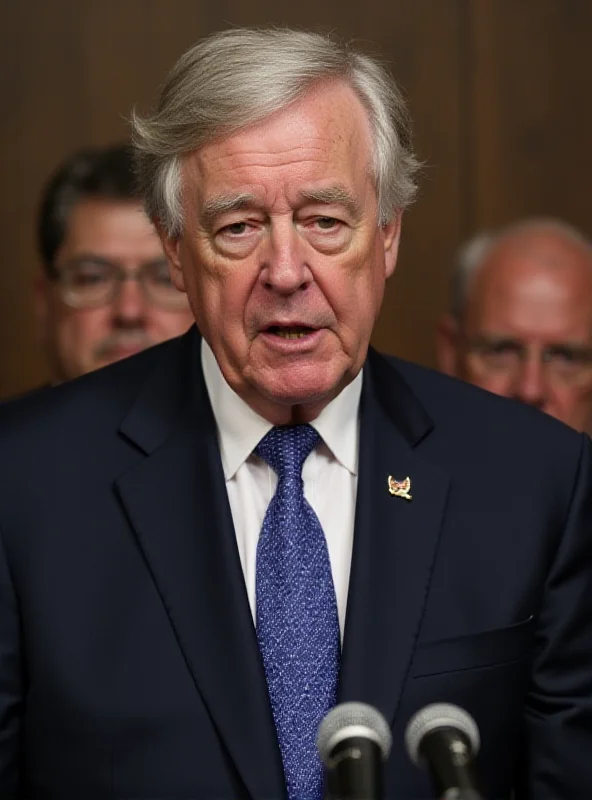

Powell's Perspective and Buying Opportunities

Federal Reserve Chair Jerome Powell recently commented on the weakening economic mood since the beginning of the year. While acknowledging the shift in sentiment, Powell cautioned against relying too heavily on sentiment readings as predictors of spending behavior. He indicated that the Fed can "wait for greater clarity" before making any major policy changes. This cautious approach reflects the uncertainty surrounding the current economic outlook.

Amidst the market volatility, some experts are pointing to potential buying opportunities. The advice is to consider investing in stocks of companies whose long-term prospects are being unjustly doubted by the market. When the market undervalues a company, it can present a chance to buy low and potentially reap significant rewards in the future. This strategy requires careful research and a long-term perspective.

Remember, investing always carries risk, and it's important to consult with a financial advisor before making any decisions. Stay informed, stay patient, and navigate the market with caution.

For those seeking career stability during uncertain times, exploring opportunities in sectors less vulnerable to government layoffs might be a prudent strategy. Researching industries with consistent demand and growth potential can provide a sense of security amidst economic headwinds.

In summary, the market is presenting a complex picture. While recession fears linger and bank stocks face challenges, opportunities for strategic investing and career stability remain. Staying informed and adaptable is key to navigating these uncertain times.