The financial world is facing a confluence of factors that are causing concern among investors. Two major themes are emerging: a perceived waning of the "Trump effect" on markets, particularly cryptocurrencies, and growing anxieties surrounding potential tariff escalations. Let's delve into these issues.

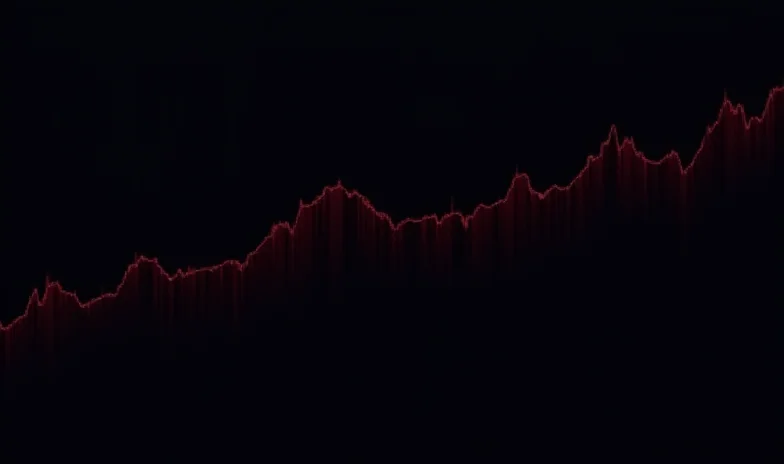

Bitcoin's Tumultuous Ride

Bitcoin has experienced a significant downturn recently, falling below $80,000 for the first time since November and losing approximately one-fifth of its value. This decline has sparked debate about the underlying causes, with many attributing it to a broader market correction and the diminishing impact of factors previously associated with Trump's influence. Some analysts point to specific "events" that triggered the plunge, although details remain somewhat vague. "The world of cryptocurrencies was hit by two events," according to several reports, contributing to the market slump.

This downturn raises questions about the long-term stability of the cryptocurrency market and whether it can maintain its value independent of external factors, including political figures and specific market events. Is this a temporary correction, or a sign of a more fundamental shift?

The Specter of Tariffs

Beyond the cryptocurrency market, the potential for escalating tariffs is also causing unease. Concerns are being voiced about the impact of these policies on global trade, particularly for export-driven economies. One example is Italy, where the Minister of Enterprises has expressed worry about the potential consequences. "Italy is concerned, we are a great exporter," they stated, highlighting the vulnerability of the Italian economy to trade barriers.

Interestingly, perspectives on tariffs appear divided. While some express concern, others view them as potential bargaining chips in international negotiations. Lega leader Salvini, for example, has suggested that "tariffs are bargaining chips and Trump is a businessman," implying a strategic approach to trade negotiations. This difference in opinion underscores the complexity of the issue and the uncertainty surrounding future trade policies.

A Word from Elon and Skincare Innovation

The article also touches upon Elon Musk's involvement with the Trump administration, where he reportedly provided "tech support" and warnings about potential US bankruptcy. While seemingly disparate, this highlights the intersection of technology, politics, and economics in the current climate. Furthermore, in a separate development, Beiersdorf, the company behind Nivea, is aiming for growth through innovative skincare products, even as it faces potential headwinds from Trump's tariff policies.

Ultimately, investors are advised to remain vigilant and informed as these complex and interconnected factors continue to shape the global economic landscape.